Written By: Kevin Baker Jacinto

The U.S economy presents a lot of fear in the hearts of many Americans. The U.S economy is feared by most middle-class families, and it has to do with wrongful information that is being presented in our society and media. Does the fear of the U.S Economy stem from historically high prices for gasoline? Is it the increasing rate of Americans losing their homes due to Foreclosure? Or maybe it’s because the value of the U.S Dollar is decreasing?

The truth is that the middle-class Americans are faced with an interesting dilemma in the United States. This fear is that the dilemma is that the middle-class will be whipped out in the near future. The unseen and real fear is that middle class as we have come to understand it will no longer exist. The idea that the middle class will diminish is a fear unseen by the majority of people living in the United States. With the historical higher gas prices, housing crisis, and the dollar loosing value at historical rates, we will see this reality come true in the very near future. This is an interesting time in history where middle-class Americans need to be careful where they put their money. It is where they place their money today, which will decide if they are in the rich or poor class in the future. In the near future, America will split in half between the rich and poor class. The downward economic collapse that we are starting to witness in America will only get worse, if we are not careful with our money. The upcoming U.S economic collapse is the cause of the split between the rich and poor class, in effect diminishing the Middle Class in America.

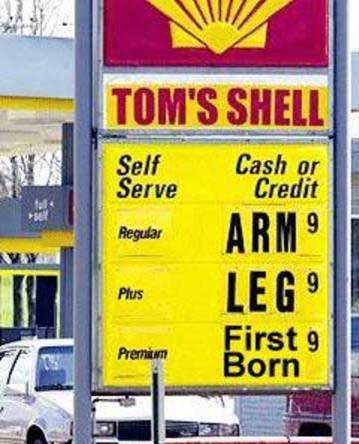

I went to the gas station the other day. It personally took me $50.00 to fill up my gas tank! I drive a 2004 Toyota Corolla. I enjoy my Toyota Corolla as it is safe and fuel efficient and even with higher gas prices I know I’m saving money in comparison to other cars. The thought occurred to me, how much the larger, less fuel efficient cars would take to fill up their gas tank? I can only begin to wonder how these prices are starting to really effect the cost of living for Middle-class Americans. I do know that many people are feeling the pinch in their pockets as the price of gasoline continues to reach historical levels in pricing. An editor from Multinational Monitor contends, “ In the scope of a year, the price of oil has doubled-and prices in the $90-a –barrel range are quickly becoming normalized” (p.1). What happens if the prices of gasoline continues to increase?

I do know that gas prices are at historical prices, mixed in with millions of Americans losing their homes, and the dollar loosing value combined all together is a major fear for Middle-class Americans. This is a reasonable fear. These three factors higher gas prices, housing crisis, and the U.S dollar dropping in value, are more heavily felt by the middle-class American. It is more heavily felt by Middle-class Americans because the rich class (generally speaking) don’t feel the pinch as much as the Middle-class American does, it doesn’t hurt a multi-millionaire that he/she has to pay an extra dollar or two on gasoline per gallon. The poor class don’t normally have cars so they are not being directly affected by it as far as money is concerned. It was not the poor or the rich people buying homes in 2004-2007. It was the middle-class purchasing homes because it was so readily available. This middle-class that bought these homes at the peak of the market now are at a devastating dilemma in where they have either lost their home, endanger of loosing their home, or are hanging tightly to the home by barely making their mortgage payments. The middle-class needs to wake-up to these economic times we are currently facing, and choose what side they want to be on, the rich or the poor, the clock is ticking. It is what they Americans do with the money they have that will catapult them into the rich or poor class in the very near future. The U.S economy will collapse and the middle Class of America will become extinct. Christian Wedller the writer of The Middle Class Falls Back, Wedler contends that, Middle-class families are clearly struggling financially. In September 205, the average two-earner family needed to work 32.0 weeks to pay for taxes and a range of middle-class items (health care, housing, college, and transportation)”(p.1). This is why the middle class will be extinct because they are the social class that are getting squeezed, because it is the middle-class that are the primary social class purchasing these necessities.

Still there are many that are more optimistic about the state of the economy. The opposing side would argue that they absolutely don’t see the middle-class diminishing anytime soon. Most of these that feel that the U.S economy is solid and will continue to grow strong in the future. Some feel that economic times will get better and that for the most part, the middle-class will remain strong economically in America.

According to Jack Malehorn a writer for the Journal of Business forecasting, Malehorn states, “Economic Consensus Outlook remain steadfast in their belief that the economy will continue forward into the year ahead, though at a slower rate”(p.1). They feel that the economy is going to continue to be solid, and middle-class American’s shouldn’t worry.

Gas prices

The fear of gas prices is that we are paying too much for it. Americans are used to paying cheap prices for gas. Well the whole idea of global warming coming and how the gas we use pollutes the air, should be a wake up call to Americans to move towards energy efficient vehicles such as electric cars. You see it’s all really connected. The fear of gas prices and not being able to pay for gas means switch the car you are using, not only will you be paying less, but also you will be saving the Earth. Reporter Peter Katal contends, “But as 2008 began, American drivers were paying more than $3 a gallon, and crude oil hit a milestone — $100 a barrel. Some oil experts warn of even bigger price shocks to come as oil-producing nations use more and more of their own oil, and energy demand jumps 50 percent by 2030” (p.1).

Another expert agrees and is also concerned about the high levels of prices in the U.S. is Thomas Billiterri. Billiterri “Pressed by rising gas prices, highway gridlock and global-warming concerns, cities are spending unprecedented amounts on public transit systems — from streetcars and other “light-rail” lines to commuter trains and rapid-transit buses.”(p.1). The growing gas prices makes it much more difficult for families in the middle-class because they are the ones that feel the pinch in their pockets more heavily. The really poor in this country don’t drive cars, and the really rich in this country aren’t directly effected by higher gas prices. So the middle-class hardworking citizen of America is the person that is becoming effected by this and the high price of gas is definitely effecting their lifestyle and forcing them to contend to lower standards of living.

The flip side of the higher gas prices, means that more Americans will start going into purchasing energy efficient vehicles such as electric cars, or other high-tech energy efficient alternative technologies. Mary Cooper states, “Proponents of renewable fuels say non-polluting hydrogen could not only help end U.S. reliance on Middle Eastern oil but also dramatically reduce air pollution and emissions of carbon dioxide, the main greenhouse gas linked to global warming.” This will save many Americans money along with helping out the environment.”The middle-class American who is looking forward to these new alternative technologies are confident in the U.S economy, seemingly always finding a way to have the pros out-weight the cons”(p.1).

Housing Crisis

The housing crisis in America is another major fear within the U.S economy. Many people are losing their homes due to foreclosure. According to Marcia Clemmitt “The average American today can’t afford to buy a home at current prices”(p.1). Robert Hardaway, a professor of law at the University of Denver. “The average home in California costs $500,000. You can’t afford that home.” But easy initial mortgage terms made many buyers believe they could, which led to today’s record defaults and foreclosures” (p.1). This foreclosure crisis forces people to rent, or remain homeless. This is bad for the economy, because as the dollar losses value, rents go up and the real looser is the person that is renting. The housing crisis took place because loan companies were giving fake loans to potential buyers. In other words many people between 2003-2007 were able to purchase homes that they otherwise couldn’t afford. This has led many Americans into foreclosing their home and being forced to sell.

According to Marcia Clemmit, “More than 2 million borrowers will lose their homes to foreclosure because of subprime mortgage lending in recent years. With the housing market booming, lenders enticed many lower-income people into buying homes they couldn’t afford by offering adjustable-rate mortgages (ARMs) with temptingly low initial teaser interest rates.” The more people are loosing homes and becoming homeless, the idea of the middle class diminishing is starting to become clear.

The housing crisis is definitely taking it’s toll on American families. There is a specific example which illustrates this point further. My close friend bought his home in 2005 pretty much at the peak of the market in his area. His intention was to sell it for a quick profit. He realized that the price of his home started to loose value the moment he bought it. He no longer could afford his payments on his house, and the price was dropping tremendously. He was devastated. In 2007 he, like many other Americans who bought property at the wrong time, put his house for sale, and ultimately had to claim for bankruptcy. He could no longer afford the home and now the bank owns the property. He now lives with his grandma in a small 2 bedroom apartment in West Covina, and although he is employed, he struggles to survive with the circumstances he is faced with. My friend says, “ I didn’t know what I got myself into, the housing mess has been tragic, for my finances! ” The unfolding of the split between the have’s and have-nots are starting to become evident with this major housing crisis. With the “have’s” owning a home and the have-not’s worried about renting a place to live in and struggling to pay their rent. Lorna Bourke an editor for Money Marketing states, “Rising house prices are widening the gap between the relatively wealthy and the less well off and are in danger of excluding sectors of society from ever owning their own homes” (p.1).

Still few argue that the housing crisis is now over, and now is the perfect time to buy a home. The middle-class individual who has money saved up, good credit, solid proof of a steady income are now looking at homes way below market value. This is a good sign for first time buyers, and the opportunities for the people that want to buy homes the “right” way are optimistic about the housing market, and for that matter the state of the economy. It is actually a great time for real estate investors to start buying while the prices are low, as they can watch their property appreciate in the long-turn. The real estate market goes in cycles, the Real estate investor knows this, and will time the market to his/her advantage, making huge profits if he/she “plays” is right.

The collapse of the U.S Dollar

It is reported that the dollar is loosing value by 20% annually “According to David J. Lynch of U.S.A Today “The past seven years, the dollar has lost 40% against an index of U.S. trading partners’ currencies. That’s given U.S. exports a boost, making them less expensive for foreign buyers. But it’s made imported products more costly and given American tourists in Europe sticker shock”(p.1).

The U.S dollar is losing value. An item worth today at $1.00 is going to be worth much more than that in the future. So what does the average American do about this reality? First of all they fear and worry. Then after they get over that, they save their money. They save their money in banks and trust in mutual funds. This idea is not smart. The reality that you are saving money that is not really worth anything In the future is a bad idea. The reason that most people fear the dollar losing value is because most Americans don’t understand money. They think that the more they save the more they will have. Contrary to popular belief saving dollars and the realizing that the same dollar someone is saving is loosing value is the biggest scam in America.

According to Grant, “The dominant global monetary asset is, of course, the dollar. But what is a dollar? It is a piece of paper (or an electronic impulse) of no intrinsic value. The dollar is money by dint of government fiat. The eminent monetary theorist Ben S. Bernanke, now a governor of the Federal Reserve Board, has observed that the cost of producing a dollar is trifling and that the government can produce as many dollars as it wants”(p.1).

The collapse of the U.S dollar means that many Middle-Class families that are working hard for the money either invest it wisely and grow their money and join the Rich in America or throw it away with things they can’t really afford. This is a problem because as the middle-class begins to wake up to the idea that their dollars are loosing value, they will save more, but saving more just means more worthless dollars saved up. The weakling of the U.S dollar places the average Middle-class American in a place where they don’t want to be, “savers of money that carry very little value in the future.”

There are few that would say that the dollar will never crash. The dollar will be strong in the future. The U.S dollar being strong means that the middle-class trusts in the Feds ability to continue to print out money out of thin air. The argument is that if we had a strong dollar then the middle-class would still exist.

So what do these fears of the U.S economy really mean? How does it tie into the diminishing middle class? The fear of the U.S economy is that many Americans are starting to see the warning signs of the split between the rich and poor. The three warning signs that are causing a split between the rich and poor, is the higher gas prices, the housing slump, and the value of the dollar dropping.

Firstly, it is the middle class that gets most affected by higher gas prices mainly because they are the ones that drive the most to work and school. If the prices of gasoline continues to increase, the middle class will no longer be able to afford the price of filling up their gasoline, thus sinking into the poor class. Secondly, the housing crisis has affected mostly the middle class because the middle class were the majority of people buying houses at the wrong time and are now, or will soon be losing their homes, placing them in the lower class. Lastly the dropping dollar affects the middle class the most, because they are the ones that spend the most on basic needs and with a weak dollar the spending needs to be cut back or invest into assets, or the middle class will drop to the poor class.

The flip side is that the rich don’t worry too much about these economic issues as they have more than enough money to glide through these financial times. Also, currently the poor have very little to no money so they aren’t readily affected by the economic crisis. The economic crisis is a crisis for the Middle-class American. Depending on where they invest their money today, they will either fall into the poor or rich class. The rich buy assets that go up in value while the poor try to survive on the little that they have. It’s time for the middle-class to decide where to put their money. The rich and poor class split is only seen among the select few that understand the severity of the upcoming U.S economic collapse. To understand what is going on is to be better informed with the realties all Americans are faced with today.

There are several arguments whether The U.S economy will collapse or not. Depending on what side of the fence you stand regarding this issue, the facts are still clear cut and dry. We have been in this predicament before. I think with the rate at which we are going that America will soon see this split between the rich and poor class very clearly. The middle-class is diminishing, choose a side.

RESOURCES

Billitteri, Thomas J. “Mass Transit Boom.” CQ Researcher 18.3 (2008): 49-72. CQ Researcher Online. CQ Press.. 12 July 2008 <http://library.cqpress.om.libproxy.lib.csusb.edu/cqresearcher/cqresrre2008011800>.

*Bourke, L. (2006, November 16). “Housing Elite.” Money Marketing

Retrieved July 22, 2008

Brandon, H. (2005, June 15). Official Sees Strong U.S Economy Southeast Farm Press Retrieved July 14, 2008 http://web.ebscohost.com.libproxy.lib.csusb.edu/ehost/detail?vid

Clemmitt, M. (2007, November 2). Mortgage crisis. CQ Researcher, 17, 913-936. Retrieved July 13, 2008, from CQ Researcher Online, http://library.cqpress.com.libproxy.lib.csusb.edu/cqresearcher/cqresrre2007110200.

Cooper, M. H. (2004, February 20). Exporting jobs. CQ Researcher, 14, 149-172. Retrieved July 12, 2008, from CQ Researcher Online, http://library.cqpress.com.libproxy.lib.csusb.edu/cqresearcher/cqresrr

Grant .J (2003, December 22). The Case for Silver

Retrieved July 14, 2008. From Forbes Magazine

I agree with this it is super scary because historically no country has done well economically when the middle class is gone.