Price inflation has been a part of our economic world since the last Depression. The total US Dollars floating around has increased just a tiny bit more than the size of our economy, making them just a bit less more valuable with time.

Inflation is rarely questioned because we are used to it and it’s not large. It’s even considered good policy because it penalizes taking money out of the economy by stuffing big piles of cash into a mattress. But it also covers up a lot of sins and makes it much easier to fudge the numbers.

Longtime readers will recall that just last year the watch-word was “deflation”, when prices fall. Economists were concerned that there wasn’t quite enough money in our system and that the contraction could accelerate if we didn’t take action. This included the Federal Reserve, which among other actions injected $1.6 trillion in “Quantitative Easing” into the system – essentially printing more US Dollars. This combined with our interest in increasing manufacturing exports caused allegations that a “Currency War” was at hand.

Nevermind that. Spikes in oil and food prices have created inflation and we’re humming along again. Or are we?

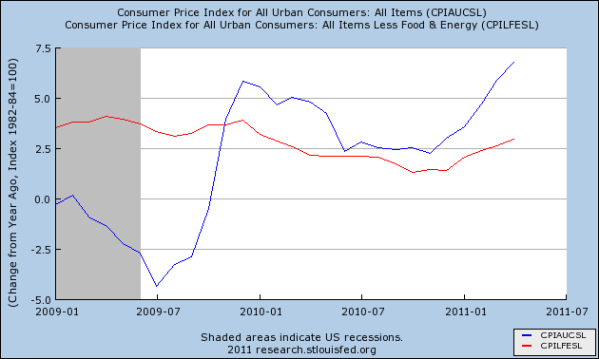

The chart below is from the St Louis Federal Reserve, as always. The blue line is the year-over-year change in the Consumer Price Index, and the red line is the same data excluding food and energy:

You can see where the overall figure drops below zero, causing the watch for deflation last year. As long as you don’t get around or eat, prices did drop through the end of the official “recession” (shaded area). But it’s clear that, leaving out food and energy, prices have been increasing at a fairly constant clip, 2-4% every year.

This means a lot more than it looks at first.

Inflation as a constant phenom gives rise to what’s called “real” data for things like investments, Gross Domestic Product (GDP) calculations, and other things. If you invest in your retirement and get 3% every year, you’re barely treading water. If you aren’t getting a raise of 3% at your job, you’re just even. And if the economy isn’t growing at that rate we’re never going to create the jobs we need. All of that assumes no one eats, of course – right now, inflation is actually around 7% overall. If you like to eat and are getting less than that, you’re losing ground every year.

But if you like to eat nothing but fudge, the official stats offer a lot for your diet. Consider this observation from the interesting site (which I am still working to make sense of) called the “Consumer Metrics Institute”, an unnamed group that states: “Many ‘leading’ economic indicators are published, but few (if any) are sufficiently ‘leading’ to be meaningful to investors.” Yes, they are after my own heart! They consider the “Price Deflator” – the flip-side of inflation as the Dollar becomes worth less every year, and its effect on our GDP:

The importance of the price deflater used by the BEA (Bureau of Economic Analysis) cannot be overstated. In calculating the “real” GDP the BEA continued to use an overall 1.9% annualized inflation rate, which is substantially lower than the inflation rates being reported by any of the BEA’s sister agencies. The mathematical implications of the deflater are simple: a lower deflater creates a higher “real” GDP reading. If April’s CPI-U (as reported by the Bureau of Labor Statistics) of 3.2% year-over-year inflation is used as the deflater, the reported 1.84% annualized growth rate shrinks to a 0.56% annualized rate, and the “real final sales of domestic products” is actually contracting at a 0.63% rate. If instead of the year-over-year CPI-U we were to use the annualized CPI-U from just the first quarter (5.7%), the “real” GDP would be shrinking at a 1.82% annualized rate, and the “real final sales of domestic products” would be contracting at a recession-like 3.01%.

Summary: at a real rate of inflation running around 7%, the economy is shrinking considerably faster than noted before. Even excluding the volatile parts of the consumer price index, the calculations of “real” (inflation adjusted) GDP growth are using a bizarre number that over-states growth considerably.

Is the BEA lying to us? As Mark Twain famously observed, “There are three types of lies: lies, damned lies, and statistics”. This one has to be filed under the last category. But if you are barely treading water in your investments or salary, perhaps you can take heart in knowing that just about everyone is in the same situation right now. What you might feel in your guts is more accurate than the official numbers, however, and that makes it hard to know just where we are as a nation.

Just did a quick calculation, and at 3% you can expect the price of everything goes up 80% in 20 years. That’s about where we have been over that time, I think, but you may have better numbers. I know wages haven’t kept pace with that and I doubt that for all the hype the stock market has either.

So I’m not surprised that the whole economy is barely keeping even right now. That does feel about right.

Dale, that is about where it’s been overall. It hides a lot of sins. But I do think that this is the real root of discontent in the nation right now – the “official” numbers don’t match what people feel in their guts. In this case, intuition is quite right, and though we’re not feeling the increase in energy (read: gasoline) prices as much as we have in the past it still really hurts. We’re barely treading water – if that good.

I admit I’ve always found inflation confusing. If it always goes up about the same rate what causes it? Are we really printing money all the time? If that is the case why was there such a big deal about the “quantitative easing”?

There is something here that doesn’t add up. Perhaps you can explain it better.

Anna, it is a hard concept to get your head around. I did my best in this piece:

https://erikhare.wordpress.com/2009/03/25/money/

It says right on the bills that money is nothing more than the “Full faith and credit of the Federal Reserve”. In other words, it’s only as good as our ability to manage it – and the faith that the world puts into that. It gets a little bit less all the time – not because we’re more cynical, but because that’s how they manage it.

It makes sense to me, at least at an intuitive level, once I get past the idea that there is some kind of fixed value. There just isn’t. Everyone has to get over that.

I have felt for the past dozen years or so that I’m constantly swimming upstream–and the current keeps getting stronger as I age. 😐

I read this over several times before responding because this makes me mad. You’re telling us that even with all the analysis that you did before showing that the private economy has been shrinking for the last 10 years those numbers are probably “fudged”? That’s ridiculous! We have all these people paid a lot of money to produce information and we can’t trust any of it? Is that what you’re saying?

Jim, I think that’s the message we have to take away from this. If you’ll recall I referenced a piece by Rob Arnott after I did my write-up on the Managed Depression. The link to that other work is contained in here:

https://erikhare.wordpress.com/2011/05/13/loose-ends/

There are some discrepancies between his calculations and mine as to the “real” Real GDP (emphasis deliberate). His numbers are consistently worse, except last year. It took me a while to find out why, and I hit it almost by accident in the commentary noted above – the inflation numbers used to calculate Real GDP are just plain fudged.

I don’t think I trust a damned thing anymore, to be honest, and in the future I will calculate everything on my own to the best of my ability. This is all without going into what the GDP numbers represent, which has its own share of fudge – but that part of it I think I understand and it’s at least consistent from year to year.

I also think this is shameful behavior and that our news providers are doing an absolutely terrible job of calling out government on its abuse of important figures – especially the utterly useless “headline” unemployment rate, aka “U3”, which should never be used for anything.

Of course the income of CEO’s has gone up far more than 80% over the past 20 years. I won’t even try to guess at the percentage, but I’m guessing Erik knows it. This is my perspective on the issue of inflation:

1. The elite are doing better than ever before in history.

2. The comfortable are still comfortable enough to either not care or not notice.

3. The majority are losing ground.

4. The bottom 50% are a paycheck or two from the streets.

5. It is time for a change in the status quo.

Pingback: Lying | Barataria – The work of Erik Hare

I know that it is easy to say that government makes these figures look good to make themselves look good but I think that they want to keep us distracted. Edadvocates makes a good point about how the rich keep getting richer and part of how that happens is that no one takes them on. The more we are distracted with happy talk and fake numbers the less we will do about it.

Jan, I don’t necessarily believe in conspiracies (previous posting!) but there are times when you can imagine a lot of people who want to keep their jobs all slightly slanting things a certain way and … well, it sure acts and feels like a conspiracy. There’s an old saw in science about the calculation of the charge on an electron – JJ Thompson did it first, and he was close. Each subsequent calculation was closer to what we know is the real answer, but …. not quite where we are today. The value goes in slowly towards the right answer with each successive measurement. I think this is one of those things.

BTW, if anyone wants to dispute the numbers or simply double-check my math, I can send you my original spreadsheet – or just follow the links given to build a sheet yourself.

Pingback: Waiting for the “Go” | Barataria – The work of Erik Hare

Pingback: Summertime Blues | Barataria – The work of Erik Hare

Pingback: Moving the Economy Forward | Barataria – The work of Erik Hare

Pingback: Death of the Mighty Dollar | Barataria – The work of Erik Hare

Pingback: Fear the Dragon? | Barataria – The work of Erik Hare

Pingback: Downward Revision | Barataria – The work of Erik Hare

Pingback: Euro Contrast | Barataria – The work of Erik Hare

Pingback: Gasoline, an Explosive Issue | Barataria – The work of Erik Hare