Pepsi Vs Coke

Was reading an old article and the question was what would happen if Pepsi knew Coke’s formula or vice versa.

The answer is pure common sense. It took a genius like Kevin Murphy to get the answer.

Hiring A-Players in the downturn

Let’s face it, these great, A-Player type people are just really hard to find. Let’s say for sake of argument that A-players make up 1% of the population that could do the job, B-players are 19%, and C-players comprise the other 80%. It’s uncertain if these percentages are accurate, but there definitely are more C-Players than B-players and more B-players than A-players. Now if people find out you are hiring (through a Craigslist ad, posted on careers page, etc.), it probably means you are going to get a massive influx of resumes from C-players. Many of these resumes will be indistinguishable from those of A-players (it’s always hard to distinguish on paper). Which means the amount of noise (aka undesirable hires) will likely increase. Which means more work sifting through these resumes and talking to many more people.

It’s important to screen for great people in order to turn the volume down on all the noise.

Unfortunately, it is really hard to tell the difference between an A-player, B-player, or C-player just from a resume. Which means you need to engage with candidates and therefore you’ll have far more candidates to deal with given this economic climate. My guess – for a standard job announcement, you’ll have three times the number of C-players applying, twice the number of B-players, and the same number of A-players. Wow…your noise level has just massively increased!

Good analysis on why hiring the A-Players is more tougher in a downturn from Summation here.

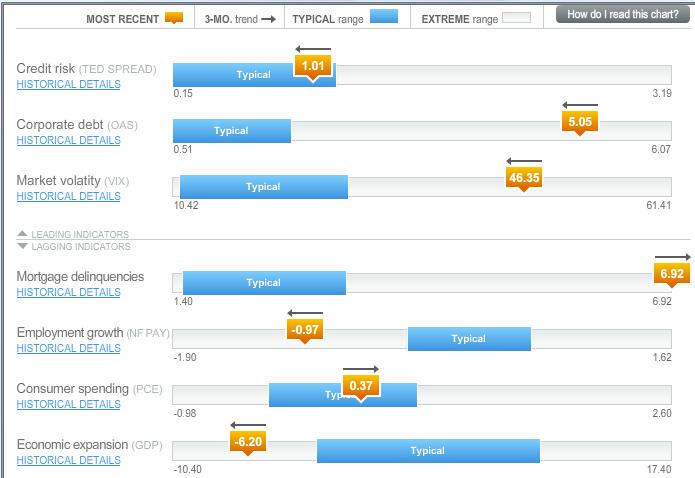

No more black swans

Here are the ten principles for a black swan proof world from Nassim Taleb in FT.

1. What is fragile should break early while it is still small.

2. No socialisation of losses and privatisation of gains.

3. People who were driving a school bus blindfolded (and crashed it) should never be given a new bus.

4. Do not let someone making an “incentive” bonus manage a nuclear plant – or your financial risks.

5. Counter-balance complexity with simplicity.

6. Do not give children sticks of dynamite, even if they come with a warning.

7. Only Ponzi schemes should depend on confidence. Governments should never need to “restore confidence”.

8. Do not give an addict more drugs if he has withdrawl pains.

9. Citizens should not depend on financial assets or fallible “expert” advice for their retirement.

10. Make an omlette with the broken eggs.

Exponential Times

Here is a remixed and revised piece of good research by Karl Fisch,Scott Mcleod and XPlane

The Browser Wars

Cloud computing has one major ingredient which is vital to its success – the browser. Below is a primer on the four major players from FT.

The internet has seen the creation of many browsers in the course of its short existence, but the main story has only four protagonists: Netscape Navigator, Internet Explorer, Firefox and Chrome.

In terms of popular usage, Netscape Navigator was the first. Everyone used Navigator – in part because there weren’t any serious alternatives – and it worked fine. Then came Microsoft’s Internet Explorer (IE), which was integrated into the company’s dominant Windows operating system, driving its growth. By 1998, IE had overtaken Netscape in terms of usage.

An antitrust suit was filed against Microsoft, but by then it was too late. IE controlled over 90 per cent market share and, despite the legal wrangling, to this day it is still shipped as the default browser on most of the world’s PCs. Netscape was bought by AOL, and after much dithering was taken out of development in 2007.

The story would end there but for the “open-source” community. Open-source software was (and to an extent still is) the scourge of Microsoft. Chief executive Steve Ballmer once referred to the Linux open-source operating system as a “cancer”. Software like this is constantly improved by a community of software developers who work on the project for little or nothing. The fruits of their labour are usually distributed free. In 1998, Netscape turned the code of Navigator into an open-source project called Mozilla – and out of that grew Firefox.

Firefox has taken 20 per cent of IE’s market share, and is still growing. Many of its features – such as tabbed browsing and accessibility settings – were available earlier on other products, such as the browser Opera, but thanks to word-of-mouth, good marketing and Firefox’s appeal to more technically literate users, it has grown to be IE’s biggest challenger. And because it is open-source, third-party developers can extend Firefox’s capabilities by building new applications, making it an even more powerful tool.

The browser market was looking like a two-horse race between IE and Firefox, with an honourable mention for the Mac-based Safari, until Google launched Chrome in 2008.

Chrome still has only about 1 per cent of the browser share but that will grow. With Lars Bak’s V8 engine, Chrome is incredibly quick. The browser uses a lot of open-source code and open standards, but has also introduced some important innovations, such as its use of independent tabs. This sounds dull, but it’s critical. Here’s why: normally, running several web-based applications through the browser can lead to a crash. And when one browser tab crashes, the whole program needs to be restarted, losing any work or activity going on in other tabs.

Chrome runs in a way that means any browser crash is limited to just that tab, so that if you are composing an e-mail in one screen, and a video crashes in another, the e-mail you are writing is not affected. You can close the crashed tab and continue working. Making the browser operate in this way –like the desktop – is crucial for the future of web applications.

Of course, the speed at which Chrome functions is also vital. For web-based applications to be a success, they need to respond quickly, or users will become frustrated. Speed, stability, security – these are all critical areas for the future of everything we do online. And the browser is the gateway.

With the launch of Chrome, many tests were made by tech enthusiasts to determine which browser is the best performance wise. Below is an interesting post from Dave Winer:

In the last few days there’s been a discussion in the blogosphere as to the future of browsers, and the continued charm of Firefox, or whether there’s any serious movement to Chrome. My original piece basically said that no matter how attractive Chrome might be, I can’t switch because so much of what I do depends on plugins that are only available in Firefox.

But part of the the discussion centered around whether or not Firefox is slow relative to the other browsers. David Naylor posted a series of tests that show that, if anything, it’s getting more efficient. His numbers are impressive. Less than half a second to launch. I’ve never measured the performance of Firefox or any other browser, and I don’t plan to. But when people talk about the speed of a browser, I don’t think of how quickly it launches or even how fast it renders a page right after it launches.

Here’s what I do care about — how slow it gets after it has been running for a number of hours with a full complement of tabs. That’s the A-B comparison that we should be looking at. I think that’s the subjective measure people use to say whether a browser is fast or slow. Ideally you only launch a browser once every time your machine boots. But how often do you have to quit the browser because it has become so bogged down and is using up so much of the machine’s resources? I wonder if most users know that you can make the browser faster by quitting and relaunching?

It’s also possible that people who use Chrome fit a different profile and don’t load it up with a lot of tabs, or the UI of Chrome discourages lots of tabs — I don’t know since I have only tried Chrome, I have not used it as my daily browser.

The financial oligarchs

Big banks, it seems, have only gained political strength since the crisis began. And this is not surprising. With the financial system so fragile, the damage that a major bank failure could cause—Lehman was small relative to Citigroup or Bank of America—is much greater than it would be during ordinary times. The banks have been exploiting this fear as they wring favorable deals out of Washington. Bank of America obtained its second bailout package (in January) after warning the government that it might not be able to go through with the acquisition of Merrill Lynch, a prospect that Treasury did not want to consider.

The challenges the United States faces are familiar territory to the people at the IMF. If you hid the name of the country and just showed them the numbers, there is no doubt what old IMF hands would say: nationalize troubled banks and break them up as necessary.

Excellent piece from The Atlantic. More here.

Geither Plan Explained

Leave on one side the question of whether the Geither plan is a good idea or not. One thing is clearly false in the way it’s being presented: administration officials keep saying that there’s no subsidy involved, that investors would share in the downside. That’s just wrong. Why? Because of the non-recourse loans, which reportedly will finance 85 percent of the asset purchases.

Let me offer a numerical example. Suppose that there’s an asset with an uncertain value: there’s an equal chance that it will be worth either 150 or 50. So the expected value is 100.

But suppose that I can buy this asset with a nonrecourse loan equal to 85 percent of the purchase price. How much would I be willing to pay for the asset?

The answer is, slightly over 130. Why? All I have to put up is 15 percent of the price — 19.5, if the asset costs 130. That’s the most I can lose. On the other hand, if the asset turns out to be worth 150, I gain 20. So it’s a good deal for me.

Notice that the government equity stake doesn’t matter — the calculation is the same whether private investors put up all or only part of the equity. It’s the loan that provides the subsidy.

And in this example it’s a large subsidy — 30 percent.

The only way to argue that the subsidy is small is to claim that there’s very little chance that assets purchased under the scheme will lose as much as 15 percent of their purchase price. Given what’s happened over the past 2 years, is that a reasonable assertion?

Source:NYTimes

FT has a 3 min video explaining the plan.

leave a comment