Energy Storage

Brian Cashion

Energy Storage

Accure Battery Intelligence

Energy Storage

Jim Brown

Soltec's Board of Directors will propose to the General Shareholders' Meeting, to be held on June 25, the appointment of Mariano Berges, current Chief Operating Officer (COO), as the new Chief Executive Officer (CEO) of Soltec.

Thus, once the General Shareholders' Meeting approves Mariano Berges' appointment as CEO, he will take over the management of the company's operational divisions, both in the trackers division, primarily focused on the manufacture and supply of solar trackers, and in the energy division, which includes the development, construction, and operation of the company's renewable assets.

"It will be an honor for me to assume the role of CEO of Soltec, and I thank the Board of Directors for their trust. As CEO, my commitment is to drive operational efficiency and sustainable growth, consolidating our leadership in the renewable energy sector," said Mariano Berges.

On the other hand, Raúl Morales, co-founder of Soltec, will maintain his position as Executive Chairman, leading the supervision and monitoring of corporate strategy, institutional relations, and financial market engagement, in addition to the corresponding corporate governance and compliance functions.

"I am proud to have led this company as CEO and to have seen Soltec grow. From now on, as Executive Chairman, I will continue to oversee our corporate strategy, foster our institutional relations, and maintain close contact with the financial market. My commitment to the company remains paramount, and I want to thank the team and the Board for their continued support and collaboration on this exciting journey towards a more sustainable future," stated Morales.

With this separation of roles, Soltec demonstrates its commitment to international best practices in corporate governance and transparency.

Mariano Berges: an Executive with over 20 years of experience

Mariano Berges: an Executive with over 20 years of experience

Mariano Berges joined the company as COO last February. With more than two decades of experience in the renewable energy sector, he has played a crucial role in global projects totaling over 20 GW in solar, wind, and battery storage energy.

An Industrial Engineer with a Master's in Renewable Energies and an Advanced Management Program (AMP) from IESE, he has held high-responsibility positions in companies such as INDRA, SOCOIN, FRV, and RPC.

Berges has distinguished himself as a co-founder of several companies and a leader of innovative projects, such as the 20 MW Trujillo solar project and the implementation of

the first battery project with Tesla in the United Kingdom. His ability to create multidisciplinary teams and expand markets has enabled him to work in over a dozen countries, solidifying his reputation in the industry. Since joining, his goal has been to strengthen the company's operations and establish a foundation for greater operational efficiency and sustainable growth.

Raúl Morales: committed to innovation and sustainability

Raúl Morales: committed to innovation and sustainability

Raúl Morales is the co-founder of Soltec, a company he established in 2004. Under his leadership, Soltec has become an integrated company in the photovoltaic solar energy sector, with 18 GW of track record, presence in 17 countries, 225 GW in development, and over 250 patents. Raúl's academic background includes a specialization in Industrial Electronics as a Technical Engineer and a degree in Industrial Engineering from the Polytechnic University of Cartagena. Additionally, he has expanded his knowledge with a Certificate Program in Financial Analysis from the University of California, Berkeley.

Raúl Morales has demonstrated a combination of passion and dedication that has led Soltec to become a global leader in the photovoltaic solar market and to establish an excellent position in the markets of Latin America, Europe, and the United States. His commitment to renewable energies and his focus on operational productivity through innovation and the attraction of qualified talent have been key to his success.

Soltec | https://soltec.com/en/

SolarBank Corporation (Nasdaq: SUUN) (Cboe CA: SUNN) (FSE: GY2) ("SolarBank" or the "Company") is pleased to announce that it has entered into an amended and restated equity distribution agreement (the "Amended Distribution Agreement") with Research Capital Corporation ("RCC") and Research Capital USA Inc. (together with RCC, the "Agents") to amend the Company's existing at-the-market equity program (the "ATM Program"). The Amended Distribution Agreement restates and supersedes the previous equity distribution agreement, dated June 29, 2023, between the Company and RCC to expand the prior Canadian at-the-market equity program to the United States. There can be no assurance that the Company will issue and sell any common shares under the ATM Program. The timing of any sales and the number of shares sold, if any, will depend on a variety of factors to be determined by the Company.

Under the Amended Distribution Agreement, the Company may issue common shares of the Company having an aggregate offering price of up to US$15,000,000 (the "Offered Shares") under the ATM Program. The Offered Shares will be issued by the Company to the public from time to time, through the Agents, at the Company's discretion. The Offered Shares sold under the ATM Program, if any, will be sold at the prevailing market price at the time of sale. Since the Offered Shares will be distributed at trading prices prevailing at the time of the sale, prices may vary between purchasers and during the period of distribution. The Company intends to use the net proceeds from sales of Offered Shares under the ATM Program, if any, to advance the Company's business objectives and for general corporate purposes, including, without limitation, funding ongoing operations or working capital requirements, repaying indebtedness outstanding from time to time, discretionary capital programs and potential future acquisitions.

Sales of Offered Shares, if any, will be made through the Agents in transactions that are deemed to be "at-the-market distributions" as defined in National Instrument 44-102 – Shelf Distributions and an "at-the-market offering" as defined in Rule 415(a)(4) under the United States Securities Act of 1933, as amended, on the Cboe Canada Inc. ("Cboe") and the Nasdaq Stock Market, or any other applicable "marketplace" for the common shares in Canada. The Company is not obligated to make any sales of Offered Shares under the Amended Distribution Agreement.

The Company will pay the Agents a commission of 2.0% of the gross offering proceeds from each sale of Offered Shares and has agreed to provide the Agents with customary indemnification and contribution rights. The Company will also reimburse the Agents for certain specified expenses in connection with the entering into and performance of the Amended Distribution Agreement.

The ATM Program is being made in Canada pursuant to an amended and restated prospectus supplement dated May 23, 2024 (the "Prospectus Supplement") to the Company's final short form base shelf prospectus dated May 2, 2023 (the "Base Prospectus"), amending and restating the prospectus supplement previously filed on June 29, 2023, and in the United States pursuant to a prospectus supplement dated May 23, 2024 (the "U.S. Prospectus Supplement") to the Company's final base shelf prospectus contained in the Company's effective registration statement on Form F-10 (File No. 333-279027) (the "Registration Statement") filed with the United States Securities and Exchange Commission (the "SEC"). Prospective investors should read the Base Prospectus, the Prospectus Supplement and other documents the Company has filed with the SEC (some of which are incorporated by reference into the Base Prospectus and the Prospectus Supplement) for more complete information about the Company and the ATM Program, including the risks associated with investing in the Company.

Copies of the Prospectus Supplement, Base Prospectus and Amended Distribution Agreement are available under the Company's profile on SEDAR+ at www.sedarplus.ca and copies of the U.S. Prospectus Supplement and the Registration Statement are available on the SEC's website at www.sec.gov. Alternatively, the Agents will send copies of the relevant documents to investors upon request by contacting RCC by mail at Research Capital Corporation, 1075 West Georgia Street, Suite 1920, Vancouver, British Columbia V6E 3C9, by email at [email protected] or by telephone at (778) 373-4088.

Restatement

The Company also announces that it has identified matters which require the Company to make a restatement to reclassify certain amounts within the Statement of Cash Flows for its annual financial statements for the years ended June 30, 2023 and 2022 (the "Restatement"). Users of the Company's financial statements should note that the Adjustments (as defined below) do not change the Company's Assets, Liabilities, Revenues, Gross Profit or Net Income for the fiscal year ended June 30, 2023.

The Restatement relates to the reclassification of four items (collectively, the "Adjustments"): (1) the classification of the investment in GIC and investment in partnership units was reported in financing activities instead of investing activities; (2) the settlement of aged accounts receivable for acquisition of property, plant and equipment and related items were non-cash related and should be reported in operating activities instead of investing and financing activities; (3) the repayment of shareholder loan was reported in operating activities instead of financing activities; and (4) foreign exchange gain and loss was grouped into effect of changes in exchange rate instead of operating activities.

All changes are contained within the Statement of Cash Flows and related notes / exhibits and the net cash position of the Company as of June 30, 2023 is unchanged. The Company has filed amended and restated financial statements for the financial years ended June 30, 2023 and June 30, 2022 (the "Amended Statements") and related amended and restated management's discussion and analysis ("MD&A") for the year ended June 30, 2023.

Further details regarding the Adjustments can be found in the Amended Statements and related MD&A which are available under the Company's electronic profile on SEDAR+ at www.sedarplus.ca. The Company has prepared a note to the Amended Statements detailing the impact of the Adjustments and has revised the Supplemental Cash Flow Information Notes to the Amended Statements. Additionally, the MD&A has been amended to reflect the restated amounts for the categories of cash flow activities.

In connection with the filing of the Amended Statements, the Company is also filing CEO and CFO certifications in compliance with National Instrument 52-109 - Certification of Disclosure in Issuers' Annual and Interim Filings.

The identification of the need for the Restatement arose out of the Company's internal review procedures for the preparation of the Prospectus Supplement. After discussions with the Company's former auditor, MSLL CPA LLP, the Company assessed that the Restatement was required. As a result of this Restatement, the audit committee of the Company determined that the Company's consolidated annual audited financial statements for the year ended June 30, 2023, issued on October 23, 2023, should not be relied upon and should be restated through the Adjustments.

SolarBank | www.solarbankcorp.com

On Tuesday May 21st, GenCell hosted a first U.S. demonstration of the Company's revolutionary hydrogen fuel products, GenCell EVOX and GenCell REX. GenCell Inc., the U.S.-based subsidiary of GenCell Ltd., (TASE: GNCL), a leading provider of Hydrogen2Power technologies, announced the U.S. rollout of the company's EVOX multipurpose distributed energy resource (DER) power solution combining energy storage and hydrogen-fueled on-site power generation to supplement the grid day-to-day for EV charging and to in parallel provide backup power for facilities, critical EV fleets and reliable, long-duration portable power for emergencies.

The Hydrogen2Power event, held at the Palmer Center in Austin, TX, drew over one hundred attendees from organizations as diverse as The Texas Commission on Environmental Equality, GE Vernova, the University of Texas at Austin, and the City of Austin Fire Department. All were on hand to learn about the sustainability and resilience challenges facing the U.S. energy sector and to preview how the GenCell EVOX and GenCell REX products contribute to resolving these issues.

The day – taking place only days after thunderstorms caused power outages affecting over a million customers in the Houston area - kicked off with a keynote address about the challenges for Texas to achieve resilience by Karl Popham, Chair of the Electric Vehicle Leadership Council and founder of Mobility+Energy Consulting LLC. Popham discussed meeting the key power challenge of reliability – which talks in seconds, minutes and hours - by describing his experience establishing a hybrid microgrid; next he suggested meeting the challenge of resiliency – which talks in hours, days and weeks – by adding a second phase to the microgrid incorporating new technologies such as hydrogen.

Next up was held a thought-provoking panel on energy and climate resilience moderated by Andrew Higgins, Chair of the Board at TxETRA, featuring Ken Snipes, Director of Austin's Office of Homeland Security; Jay Joseph, VP, Sustainability & Business Development, American Honda; Brian Hoff, VP Product Management, GE Vernova; Teesee Murray, Turtle Chief Strategist and President, TurtleX, and Michael Lewis, Sr. Research Engineer/Scientist at the University of Texas. The panelists shared their insights on the constraints limiting grid resilience, the need for innovation and the potential of hydrogen to overcome the constraints.

"The potential of hydrogen is just starting to be realized. Hydrogen is a great enabler of renewables on our grid, for bottling the wind and solar, transporting, exporting and moving it around the world," explained panelist Jay Joseph, American Honda Motor. "The energy density of hydrogen, its storability and transportability lends itself really well to solving that problem and that's a big part of the future we envision. That's why we are excited about the relationship with GenCell because it helps enable that vision of generating, storing, transporting, and then utilizing hydrogen when and where it's needed."

Added Teesee Murray from Turtle Inc., "Hydrogen offers the best resilience with the lowest environmental impact and when we talk about social justice and how we can improve the human condition for everybody, hydrogen is the answer - it's green business, it's good business."

Following the panel GenCell CEO Rami Reshef presented to the delighted crowd how the EVOX and REX technologies can help bridge the power gap and deliver agile resilient power wherever first responders require it when disasters happen, keeping EV fleets and facilities operationally ready 24/7."

"Our journey is driven by a bold vision: to realize a comprehensive, emission-free energy future. In the first phase we focused on Hydrogen2Power technology," said Reshef. "We are powering commercial applications with long-lasting tested backup solutions, tailored for even the most remote or extreme conditions. The conversations and connections made here today are just the beginning."

Continued Reshef, "GenCell harnesses the elements to generate power that is both Resilient and Sustainable – it doesn't have to be a tradeoff – to deliver zero-emission, distributed energy wherever the grid is instable or insufficient, empowering the world for future generations."

The event also showcased live demos of the REX auxiliary DC power solution for utility substations, the containerized EVOX hydrogen-fueled long-duration DER solution, including a demonstration of the EVOX charging a Ford Lightning truck and a demo of GenCell's GEMS proprietary DERMS software that optimizes the performance and economics of operating GenCell solutions.

Event attendees came away with not just a better understanding of how GenCell hydrogen fuel technology works, but how attainable a truly sustainable and resilient energy system can be.

"Capturing solar and wind in a bottle, this demonstration showed a lot of promise," said Amy Atchley, EV Equity Development Manager for Austin Energy. "The conversations featured an emphasis on powering critical locations, decarbonizing transportation, providing renewable energy access to vulnerable communities and more. Experiencing the show and tell of the life-size very quiet, clean generator that was charging-up an EV on-site made it feel real and was inspiring! Exciting stuff! It will take much collaboration between multiple stakeholders and entities for infrastructure deployment and affordability."

GenCell | www.gencellenergy.com

Ameresco, Inc., (NYSE: AMRC), a leading cleantech integrator specializing in energy efficiency and renewable energy, announced that Ameresco and Envision Energy have been chosen by Atlantic Green to build the Cellarhead project, a 300-megawatt (MW) battery energy storage project (BESS) with a maximum energy capacity of 624 megawatt hours (MWh). The Cellarhead BESS project will be connected to National Grid’s Cellarhead sub-station and will provide the UK with additional energy security and reliability.

Construction is anticipated to commence on site this year with connection to the electricity grid anticipated at the end of 2026. With a maximum energy capacity of 624 megawatt hours, the Cellarhead BESS project will support the UK’s ambition to achieve net zero, supporting the increased penetration of clean energy generation, decrease reliance on fossil fueled generation, and ultimately mitigate greenhouse gas (GHG) emissions.

Atlantic Green was established in 2021, as a joint venture between two entrepreneurial shareholders Nofar Energy, and Interland Group, as a UK-based platform to invest, develop, and operate grid-scale standalone battery energy storage systems across the UK. With a mission to develop a c.2 GW capacity of battery energy storage to fuel the UK’s clean energy transition, the Cellarhead BESS represents a key milestone for both Atlantic Green’s development journey and wider sustainability objectives. As part of the BESS project Ameresco entered into an EPC and O&M contract including battery supply, balance of plant, warranty, and availability guarantees. The EPC full wrap price is c. $249 million (196.5 million GBP). Tier 1 OEM Envision Energy will provide the BESS and associated services, as well as the equipment warranties.

Ameresco and Atlantic Green expect to finish the BESS and secure grid connection by the middle of 2026. Following completion, Atlantic Green will own and operate the BESS as an energy storage asset.

“We believe that a continuous development of battery energy storage is a vital step in the UK’s journey to achieving net-zero carbon emissions, and we are excited to team up with Ameresco to bring this vision to life,” said Nick Bradford, Managing Director of Atlantic Green. “Since our founding, Atlantic Green has consistently prioritized finding strategic ways to leverage our battery storage assets with the wider community and we are eager to answer the rising demand for battery storage with this new project with such a level of energy capacity, to really make the impact on the UK electricity system that is much needed.”

“We’re excited to announce our collaboration with Atlantic Green to construct one of the largest battery energy storage projects in the United Kingdom,” said Mark Apsey, MBE, Senior Vice President of UK Operations at Ameresco. “Energy storage is one of the key technologies required to achieve the UK’s net zero targets. Atlantic Green’s strong company leadership and robust track record of developing similar projects makes them an excellent partner in this endeavor. Together, Ameresco and Atlantic Green will help support the UK’s progress towards increased power autonomy and achieving net-zero carbon emissions by 2050.”

"This project exemplifies our commitment to pushing the boundaries of battery storage technology, a cornerstone of sustainable energy systems,” said Kane Xu, Global VP, Envision Energy. “Partnering with Atlantic Green and Ameresco allows us to demonstrate the pivotal role that advanced battery solutions play in enhancing energy security and enabling a seamless transition to renewable energy sources. We are proud to contribute our cutting-edge technology to this landmark UK initiative."

Ameresco | www.ameresco.com

Envision Energy | www.envision-group.com

Atlantic Green | https://www.atlanticgreen.co.uk

Solar Simplified, a leader in the Community Solar industry, is proud to announce a significant expansion of its footprint into Massachusetts. In partnership with LastMile Energy, they will be offering the opportunity for Community Solar subscription to hundreds of new accounts within the Eversource utility through eight new Community Solar projects in the first tranche in 2024 and additional projects in 2025 and beyond.

Solar Simplified’s innovative Community Solar offering enables residents and local businesses to enjoy the benefits of solar energy without the need for onsite installation or upfront investment. By subscribing to local solar farms, participants can expect guaranteed savings on their electricity bills while contributing to a cleaner and more sustainable environment.

Aviv Shalgi, CEO of Solar Simplified, expressed his enthusiasm for the new collaboration, stating, “We are thrilled to work with LastMile Energy and bring our services to Massachusetts. This partnership allows us to extend our mission of making solar energy accessible and affordable to more communities. We look forward to making a positive impact in the region while helping people save money on their utility bills.”

Low and moderate-income households, who will see the most significant financial benefit, are the focus of these upcoming projects. Income-qualified households will receive a guaranteed 20% discount on all applied solar credits, which is the highest discount available in Massachusetts today. Households that don't fall within these income brackets are also welcome to enroll and will qualify for a 10% discount.

“It’s a pleasure to partner with Solar Simplified and serve the local communities in Massachusetts,” said Sachin Patel, CEO and Founder of LastMile Energy. “The Maynard projects are committed to serving low-income families in the region and offer a deeper discount, which is likely to significantly improve the savings to our subscribers.”

Solar Simplified’s Community Solar offering provides a risk-free opportunity for participants, with no subscription or cancellation fees. By prioritizing residential and small commercial accounts, Solar Simplified ensures broad accessibility and substantial savings for the community.

This expansion presents an appealing opportunity for Community Solar project owners and developers as well. Partnering with Solar Simplified means tapping into a well-established network and benefiting from industry-leading expertise in managing and promoting Community Solar projects. Our proven track record of successful campaigns across various states and programs, in addition to fostering community engagement across the nation, ensures that with Solar Simplified, projects will reach full enrollment regardless of their location. Uniquely to the industry, Solar Simplified does not charge anything for subscriber acquisition and guarantees full subscription and full collection. This minimizes risk for developers and aligns incentives with project owners and financing parties, ensuring a simple, seamless and efficient project execution.

This expansion into Massachusetts marks a significant milestone in Solar Simplified’s growing portfolio of Community Solar projects across the United States. The company continues to support the development of renewable energy infrastructure through sustainable community benefit, engagement and continued education.

Solar Simplified | www.solarsimplified.com

Prisma Photonics, the award-winning grid technologies startup that utilizes advanced optical fiber technology to monitor large-scale power utility infrastructure, announced that it has appointed longtime industry veteran Tiffany Menhorn as Head of Sales, North America. Founded in 2017, Prisma Photonics works with leading power utilities in the United States, Europe, Israel and other regions to deploy solutions that identify faults and threats like icing or wildfires on transmission assets in real time while offering hyper-accurate line ratings. Prisma Photonics also helps utilities comply with U.S. Federal Energy Regulatory Commission (FERC) regulations by increasing capacity on congested networks.

Prior to joining Prisma Photonics, Menhorn served as vice president of utility solutions at Palmetto, a leading provider of energy intelligence data, where she helped utilities drive consumer adoption and commercialization of utility-sponsored third-party ownership of clean energy. Previously, Menhorn led business development for North America at LineVision, a grid-enhancing technology company, where she worked with a variety of American power utilities to integrate power line monitoring sensors while opening global markets. Tiffany also spent five years leading sales for the western United States at Enel X, where she helped change how electric utilities procure commodities, allowing them to source gigawatts of thermal and renewable power with more efficiency and transparency.

"As Prisma Photonics continues to expand its footprint in the U.S. and Canada, we are thrilled to welcome Tiffany as Head of Sales, North America,” said Eran Inbar, CEO of Prisma Photonics. “Her extensive experience within the utility space and especially her track record in integrating grid-enhancing technologies with some of America’s largest power utilities will be of immeasurable help to our growth in the market.”

Prisma Photonics' optical fiber sensing technology covers several infrastructure sectors, including power, oil and gas pipelines, subsea infrastructure, railways, highways, and other long-range utilities. It allows operators to increase the safety, efficiency, and cost-effectiveness of infrastructure operations while actively supporting utility operators in achieving their net-zero goals.

Prisma Photonics | https://www.prismaphotonics.com/

PivotGen, a Chicago-based renewable energy development and repowering company, announced the addition of long-time renewable energy industry veteran Dennis Ford as Senior Vice President of Operations.

With nearly 30 years in the industry, Ford has worked with several of the renewable energy industry's leading brands, including almost two decades working with GE Renewables. Most recently, Ford served as Regional Chief Operating Officer at TLD North America where he oversaw the P&L of three industrial businesses and achieved financial and growth targets through strategic budget and supply chain management. Ford also held executive roles with Suzlon Wind Energy Corporation, where he managed and expanded their technical and field services, developed and trained the Field Service Engineering team and created repowering product offerings. As SVP of operations, Ford is tasked with building an organization focused on project execution, operations & maintenance, and procurement that executes the company's vision.

"We are thrilled to welcome Dennis Ford as our new SVP of Operations. Dennis has demonstrated exceptional leadership and expertise in operations, manufacturing, product development, and field services," said PivotGen CEO, Tim Rosenzweig. "His proven track record of driving profitable growth and achieving operational excellence makes him the perfect fit as we create sustainable, economically impactful, and environmentally beneficial outcomes for partners and communities."

In response to his appointment, Ford remarked, "I am proud to join PivotGen to help revitalize wind projects across the U.S." Dennis attended the State University of New York Maritime College in Bronx, NY, where he studied Mechanical Engineering.

PivotGen | www.pivotgen.com

Alternative Energies Jun 26, 2023

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties. The money is there — so where are the projects? A cleaner and more secure energy ....

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

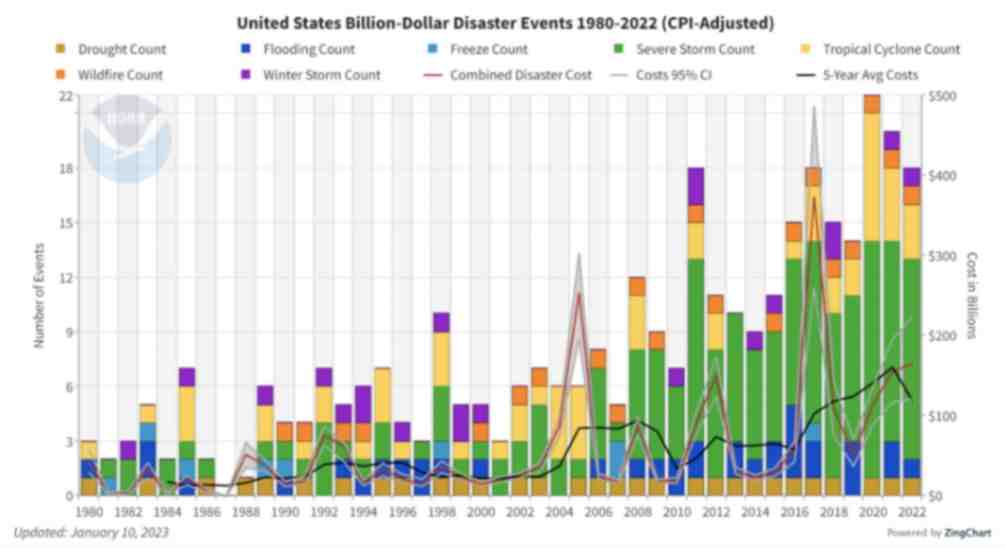

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

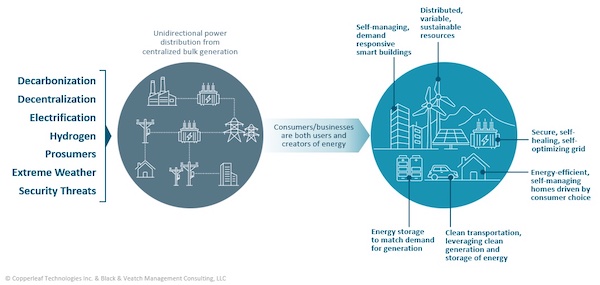

Grid modernization is having a profound impact on the nature and regulation of North American utilities. It represents a significant change to the way energy is managed, distributed, and used—today and in the future. As Environmental, Social, and Governance (ESG) targets become increasingly important to energy investors and regulators, how can organizations transform their Asset Investment Planning (AIP) processes to overcome challenges and take advantage of emerging opportunities?

Grid modernization

The energy transition refers to the global energy sector’s shift from fossil-based systems of energy production and consumption to renewable energy sources like wind and solar, as well as long-term energy storage such as batteries. The increasing penetration of renewable energy into the energy supply mix and the onset of electrification and improvements in energy storage are key drivers of the energy transition.

Grid modernization is a subset of the energy transition, and refers to changes needed in the electric transmission and distribution (T&D) systems to accommodate these rapid and innovative technological changes. Grid modernization often necessitates the increased application of sensors, computers, and communications to increase the intelligence of the grid and its ability to respond swiftly to external factors. The main goals of the grid are to provide the capacity, reliability, and flexibility needed to adapt to a whole range of new technologies (in the drive to net zero), while maintaining a comparable level of service and cost to the end customer.

Grid modernization projects are driven by both climate resilience through hardening of assets and changes to the T&D network to accommodate climate mitigation strategies. There are 3 broad categories for these types of projects:

Grid modernization is accelerating due to multiple factors, such as decarbonization, electrification, extreme weather, and security threats.

Valuing innovative projects

The changing demands dictated by grid modernization will require organizations to strike the right balance between cost-effectively managing the current business, while investing appropriately to meet future demands. Organizations are already seeing an increase in both the volume and variety of grid modernization projects. This is leading to increased planning complexity, requiring utilities to demonstrate that they are spending their limited budgets and resources to maximize value and drive their ESG and performance targets.

A value-based approach to investment decision making is key to establishing a common basis to evaluate potential investment opportunities and meet the challenges of grid modernization. The key to achieving your organization’s grid modernization goals is building a multi-year plan that breaks the work into executable chunks. This ensures adequate funding and resources are available to carry out the plan in the short-term, resulting in incremental progress toward longer-term objectives.

With a value-based decision-making approach, organizations can ensure they are making the right grid modernization investments—and justify their plans to internal and external stakeholders.

Align decisions with strategic objectives

Business leaders must develop frameworks that quantify the financial and non-financial benefits of all proposed investments on a common scale and understand how projects will contribute to their short- and long-term grid modernization initiatives and broader energy transition goals. A value framework also creates a clear line of sight from planned investments to regulatory and corporate targets, allowing organizations to provide transparency into the decision-making methodology—and demonstrate the benefits of their plans to regulators, stakeholders, and customers:

Russ is a Director of Product Management, Decision Analytics at Copperleaf. He is an innovative leader with over 20 years of comprehensive business and technical experience in high-tech product development organizations. Russ holds a B.A.Sc. in Mechanical Engineering from the University of British Columbia and a Management of Technology MBA from Simon Fraser University.

Russ is a Director of Product Management, Decision Analytics at Copperleaf. He is an innovative leader with over 20 years of comprehensive business and technical experience in high-tech product development organizations. Russ holds a B.A.Sc. in Mechanical Engineering from the University of British Columbia and a Management of Technology MBA from Simon Fraser University.

Copperleaf | www.copperleaf.com

What’s underneath the surface of the land that you plan to develop and who owns it? Identifying owners of mineral rights is critical for utility-scale solar energy projects, especially in regions where these rights are legally separable from surfac....

Since the passage of the Inflation Reduction Act nearly two years ago, U.S. solar panel makers navigate a promising market amid production, legal, and investment considerations Nearly two years after U.S. President Joe Biden signed the Inflation R....

The global shift towards clean energy — exemplified by the widespread adoption of solar power — is not only a beacon of hope for a sustainable future, but also comes with heightened expectations for responsible project execution. From the initial....

The impacts of climate change are becoming increasingly more apparent as communities around the world experience extreme weather events. From hurricanes and floods to droughts and wildfires, these types of events can have profound negatives effects o....

When thinking of renewable energy sources, you most likely picture solar panels or massive wind turbines, churning out energy to reduce the strain on electric grids and helping towns and businesses meet lofty sustainability goals. However, when an ex....

The US offshore wind sector has entered 2024 with cautious optimism as the industry shakes off negativity from last year, ready to apply learnings from a challenging 2023 to the year ahead. There are already key projects in the pipeline, including th....

As the world accelerates its transition to renewable energy sources, the deployment of energy storage solutions has surged to meet the demands of this ongoing transformation. Battery Energy Storage System (BESS) capacity is likely to quintuple betwee....

On April 19, 2019, a thermal runaway event took place in a battery energy storage unit (ESS) located within a building in Surprise, Arizona. The ESS was provided with fire detection and fire suppression, which both activated. Approximately five hours....

The summer of 2023 was the hottest in recorded history, hitting the United States with disproportionate force. A climatology report by PBS explained that the terrain in and surrounding the U.S. contributes to powerful competing air masses t....

Clean energy growth continues to outpace projections. By early 2025, renewable energy sources are projected to contribute over 33 percent of the world's total electricity generation. While exact growth rates remain in flux and often ar....

As industrial operations look for opportunities to decrease their carbon emissions, hydrogen fuel cell vehicles and battery-electric vehicles have emerged as potential solutions. These power options generate zero carbon emissions at the tai....

In the last five years, North America has experienced a significant increase in severe weather events that have impacted power grids. In Canada, Alberta's electric system operator issued 17 provincial grid alerts since 2021, due to extreme weather co....