April 11, 2011

June 18, 2011

Protected: Final Grades

Posted by mscuttle under AnnouncementsEnter your password to view comments.

May 30, 2011

Quizzes for Chapter 15 & 16

Posted by lindashidilei under Review | Tags: Chao, Kevin and Heshani, Linda Lei, Nahee, Ouyang |Leave a Comment

May 30, 2011

Chapter 15 & 16

Organizational Costs

Organizational costs are costs incurred to set up a business; such costs include legal fees and promoter’s fees.

Organizational costs are an intangible asset, where half of the costs may be expensed for tax purposes at a 10% declining-balance method.

The journal entry for organizational costs is:

Organizational Costs XX

Cash XX

Financial Statements for a Corporation

Income tax expense occurs in a corporation where net income means income after tax.

Statement of retained earnings replaces statement of owner’s equity in a proprietorship

It measures changes that result from net income, which increases retained earnings, and dividends, which decreases retained earnings.

Shareholder’s equity in a corporation is divided into share capital and retained earnings. Total shareholder’s equity is the sum of the two.

Investments

Shares are issued in exchange for cash and in this case the journal entry is:

Cash XX

Common Shares XX

Other assets can also be exchanges for common shares and the journal entry is:

Asset (cash, land, building, etc) XX

Common Shares XX

Preferred Shares

Preferred shares are another class of corporate shares and often include a preference of payment of dividends and distribution of assets in liquidation.

Different types of preferred shares are:

Cumulative preferred shares– entitle preferred shareholders to receive all their past as well as current dividends before the common shareholders may receive any dividends.

Non-cumulative preferred shares– entitle preferred shareholders to receive only their current dividends if declared and cannot claim any previous dividends which weren’t declared at the time.

Unpaid dividends/Arrears– they appear on the balance sheet when declared, but one must place a footnote to disclose the amounts.

Participating preferred shares– entitle the preferred shareholder to additional dividends including their stated amount

Convertible preferred shares– allow one to exchange preferred shares for a fixed number of common shares

Journal entry for issuing preferred shares is:

Cash XX

Preferred Shares XX

Dividends

Dividends are a distribution of earning and they decrease retained earnings as one pays dividends with cash from retained earnings.

There are three important dates that affect dividends:

Date of declaration-record the dividend as a liability

Date of record-nothing is recorded

Date of payment-record payment to shareholders

There are two methods when it comes to paying dividends which are:

Method 1

1. Retained Earnings XX

Common Dividends Payable XX

2. Common Dividends Payable XX

Cash XX

Method 2

- Cash Dividends Declared XX

Common Dividends Payable XX

- Common Dividends Payable XX

Cash XX

- Retained Earnings XX

Cash Dividends Declared XX

Preferred Dividends– a fixed amount that must be paid before the common shareholder receives dividends. It is used as leverage for the common shareholders. It is a way to raise capital and one doesn’t lose control. The preferred shareholder earns a fixed return and any excess in profits is considered a return for common shareholders.

The journal entry for preferred dividends is:

1. Retained Earnings XX

Preferred Dividends Payable XX

2. Preferred Dividends Payable XX

Cash XX

Shock Dividends– A corporation distributes additional shares from its own stock to shareholders and they do not receive any payment for doing so. This transfers a portion of equity from retained earnings into contributed capital. This increases retained earnings.

This is done to keep the market price of stock affordable and conserves cash for the expansion of a business. It also provides evidence for management that a company is doing well.

The journal entry for declaring and distributing stock dividends is:

1. Retained Earning XX

Common Share Dividends Distributable XX

2. Common Share Dividends Distributable XX

Common Shares XX

Stock Splits

Distributing additional stock to shareholders according to their percentage ownership and calling in outstanding shares and replacing them with more than one new share for each old share is a stock split. There are no journal entries and only affect the shareholder’s equity as the number of shares increases or can decrease if it was a reverse stock split, which reduces the number of shares.

Repurchase of Shares

Corporations may choose to repurchase shares that may have retired or been cancelled from its outstanding share capital.

Nothing is gained on repurchasing shares, but Contributed Capital from Retirement of Common Shares may remain is shares are retired for less than the average of the issue price.

Retained earnings decreases when retired shares are retired for more than the average issue price.

The journal entry for repurchasing shares that were retired for more than the average issue price is:

Common Shares XX

Retained Earnings XX

Cash XX

If there is a balance in Contributed Capital from Retirement of Common Shares, then this account is used for the extent of its balance.

The journal entry is:

Common Shares XX

Contributed Capital from Retirement of Common Shares XX

Common Shares XX

Earnings per Share

The formula for basic earnings per share is:

Basic earnings per share = (Net income-preferred dividends) / Weighted average of outstanding common shares

By: Niesanthan, Kuzie, Deep, Chris, Hanaga, Kojana

May 19, 2011

Stock Dividends and Splits Examples

Posted by mscuttle under Class Material, Unit 5 | Tags: stock transactions |Leave a Comment

May 18, 2011

Frequently Asked Questions

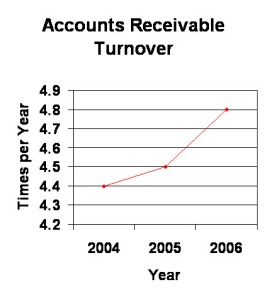

Can I combine ratios on one graph?

It depends on the ratio. Some ratios it makes sense to analyze together (current and quick ratios). Some ratios show the same information in different ways (debt and equity ratios). For these ratios, you can combine them on the same graph. Be careful that the axis are the same for both graphs. For instance, the A/R Turnover ratio and the Days Sales Uncollected are closely related but are not measured in the same units – one is a ratio and one is in days. They could be combined but you would need a left and right axis.

Can I combine my analysis of ratios?

Where it makes sense, yes. Debt and equity ratios are inverses of each other and can be discussed at the same time. The idea is to be clear and detailed but not repetitive. If you find yourself repeating the same points, you could combine the analyses.

How long should it be?

As many pages as needed but no more so. Quality not quantity! Use the exemplars as a guide.

Do I have to do all the ratios?

You must do all that apply to your company. If you are a service company you don’t have inventory and so you don’t have an inventory turnover ratio or a day’s sales in inventory.

I can’t find….

Current Assets Above Inventory… This is simply the total of all assets listed above inventory on the balance sheet. If you don’t have inventory, ask me in class what assets to look at.

Average Inventory… take the current inventory, the previous year’s inventory and average the two.

Net Sales on Credit… Use total sales or total revenue

Cost of Goods Sold… Find the closest expense (it may be total operating expenses) and make a note in your analysis that you couldn’t find the COGS number and explain what that means for your analysis.

I lost my ratio guide!

Here is another copy.

Below are examples of a ratio analysis at each level of performance.

May 16, 2011

Textbook questions:

- pg 787, #15-3

- pg 788, 15-8,

- pg 789, 15-10

- pg790, 15-12

- pg791, 15-13

May 10, 2011

May 9, 2011

Capital Assets

- Assets that are used in the operation of a company and have useful lives that are longer than one period

Amortization

- cost that helps match the cost of a capital asset over the time the asset is used

- Amortization Expense and Accumulated Amortization are used to record amortization over the period and the useful life of an asset

- Amounts used to calculate amortization are:

- Cost – the initial cost of the asset

- Salvage Value – the estimated value of the asset at the end of its useful life

- Useful Life – the estimated length of time the asset can be used

- Units Produced – the estimated number of units the asset can produce through its useful lifetime

- Methods of Amortization:

- Straight Line Method– the same amount is amortized each full period of the asset’s useful life

- Straight Line Method– the same amount is amortized each full period of the asset’s useful life

- Double Declining Balance Method* – larger amounts are amortized during the earlier years of the asset’s useful life and decreases year after year

- * salvage is not used in calculations, and be careful not to exceed the total value

- Units of Production Method*– amortization calculated by the number of units that are produced in each period

- * Remember to Check if the estimated total units of production is equal to the actual units of production

- To journalize amortization, debit amortization expense and credit accumulated amortization

Partial Year Amortization:

- Two methods of amortization

- Nearest whole month

- Half year rule: first year is always half a year regardless of time of purchase

Revising Amortization Rates

- When it is discovered that the original estimate was inaccurate one must change the amortization

- One revises the rate when:

- Assumptions are changed

- The device changed or an addition was made

- Example: Ronald has purchased a tickle machine for $1000 on Jan 2nd 2005 and estimates it will have a life of 4 years and have a final salvage value of $100. At 2006 he sprays it with scented lavender adding $225 to the device and increased the life by 1 year. What was the amortization expense in 2006.

- (1000-100)/4 = 225

- 1 * 225 =225

- ((1000-225)+225))/(4-1+1) = 225

- One revises the rate when:

Disposal of Capital Assets

- Discarding, selling or exchanging assets due to obsolescence or damage

Journalizing Steps

- Record amortization expense up to date of disposal

- Update accumulated amortization

- Remove the balance of disposable asset

- Record the cash or account receivable

- Journalize any loss or gain from the book value

- If the asset is fully amortized, and there is no loss, it would be journalized as an example below:

- Ex, A machine costing $2000, with accumulated amortization of $2000 is discarded on April 17th, 2005.

Apr 17 Accumulated amortization, machine 2000

Machine 2000

To record disposal of asset.

- If the asset is not fully amortized, then record a loss (debit) equal to the book value.

- Ex. A machine costing $8000 with accumulated amortization of $6000 on December 31st, 2008 is discarded on July 1st, 2009. The equipment is being amortized for 8 years w/o salvage value.

Jul 1 Amortization expense, machine 500

Accumulated amortization, machine 500

To record amortization.

Jul 1 Accumulated amortization, machine 6500

Loss of disposal 1500

Machine 8000

To record the disposal of machine.

Selling Capital Assets

- When the value received for the asset sold is greater than its book value, it is a gain.

- When the value received for the asset sold is less than its book value, it is a loss.

- Debit: cash received and accumulated amortization

- Credit: asset cost

- Ex. Fitness equipment costing $16000 with accumulated amortization of $12000 (on Dec 31st, 2009) is sold on April 1, 2010 for $7000. Annual amortization is $4000 (straight-line).

Apr 1 Amortization expense, equipment 1000

Accumulated amortization, equipment 1000

To record amortization.

Apr 1 Cash 7000

Accumulated amortization, equipment 13000

Equipment 16000

Gain of disposal 4000

To record disposal of equipment.

Intangible Assets

Intangible assets serves are rights, privileges and competitive advantage to the owner of these capital assets. Intangible assets as the name suggests has no physical form and are usually acquired for operational use. These assets are also non-current assets, and their useful life is hard to determine due

Examples of Intangible assets:

- Patents

- Copyrights

- Leaseholds

- Leasehold Improvements

- Goodwill

- Trademarks and Trade Names

Amortization for Intangible assets

- Amortize over a shorter economic/ legal life, and has a maximum of 40years

- No contra accounts (ie of contra account is accumulated amortization)

- Amortization account is an expense

- Use straight line method unless told otherwise

Patents

- Is an exclusive right to a company to manufacture and sell patented goods/ machine

- When purchased the account “Patents” is debited

- The cost is amortize over the shorter of its legal life/ estimated useful life

Copyright

- Granted by the federal government or by international agreement

- Gives the owner the exclusive right to publish and sell their artistic work (music, literacy, or art)

- Useful life: the life of the creator + 50 years (however most copyright has a shorter life)

- Amortized over its useful life

Goodwill

- Goodwill is no longer amortized under revised Canadian GAAP

- The amount by which the amount paid for a company exceeds its market value

- ONLY purchased goodwill is intangible